40 what is a coupon payment on a bond

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ... en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

› publications › p1212Publication 1212 (01/2022), Guide to Original Issue Discount ... The holder of a stripped coupon has the right to receive an interest payment on the bond. The rule requiring the holder of a debt instrument issued with OID to include the OID in gross income as it accrues applies to stripped bonds and coupons acquired after July 1, 1982.

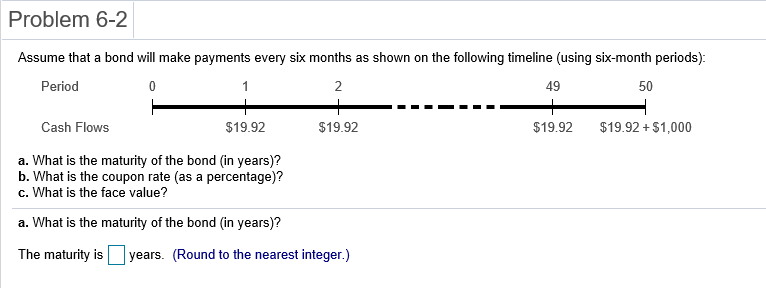

What is a coupon payment on a bond

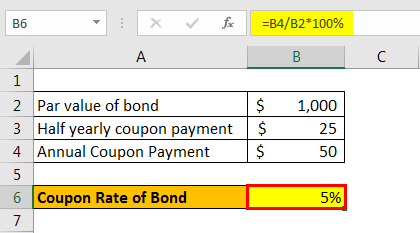

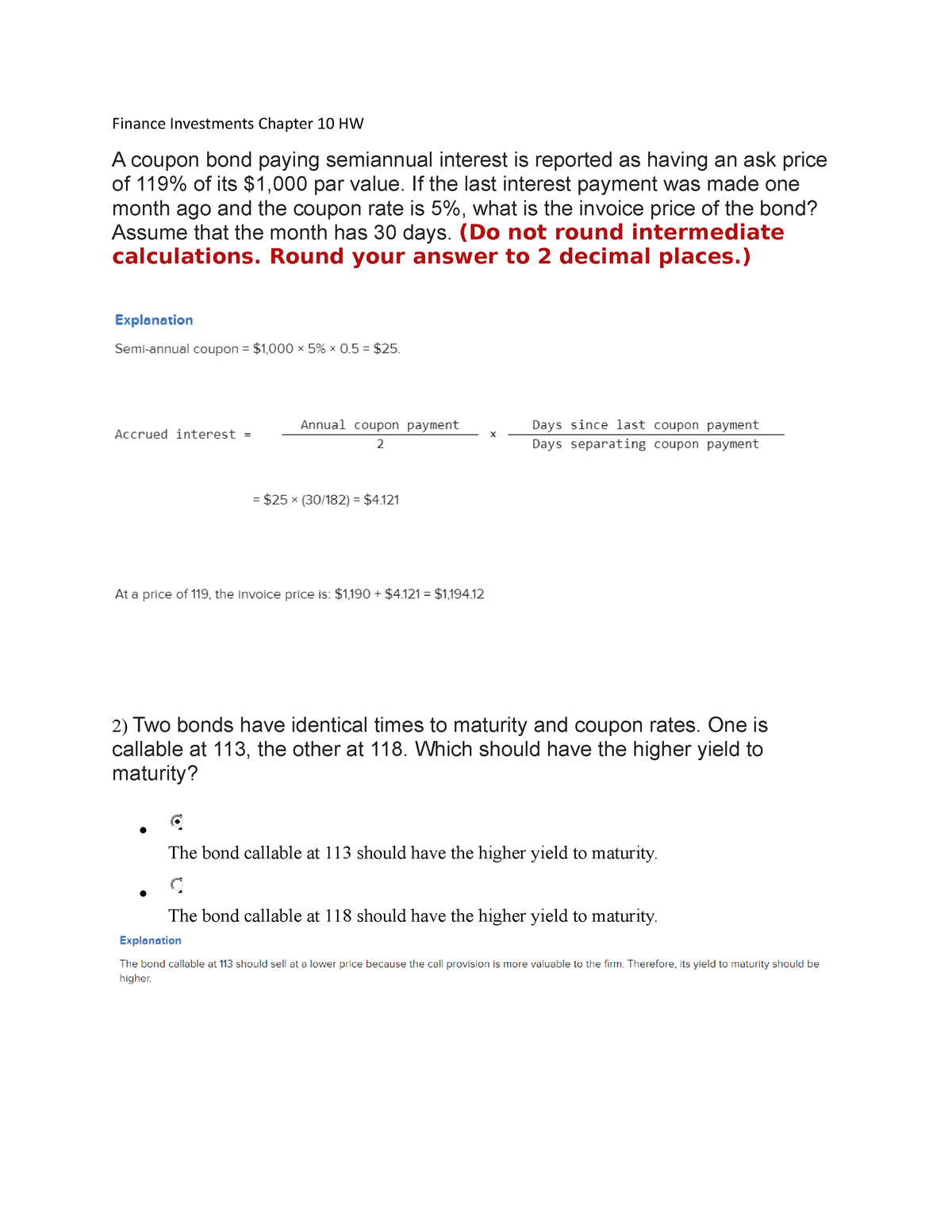

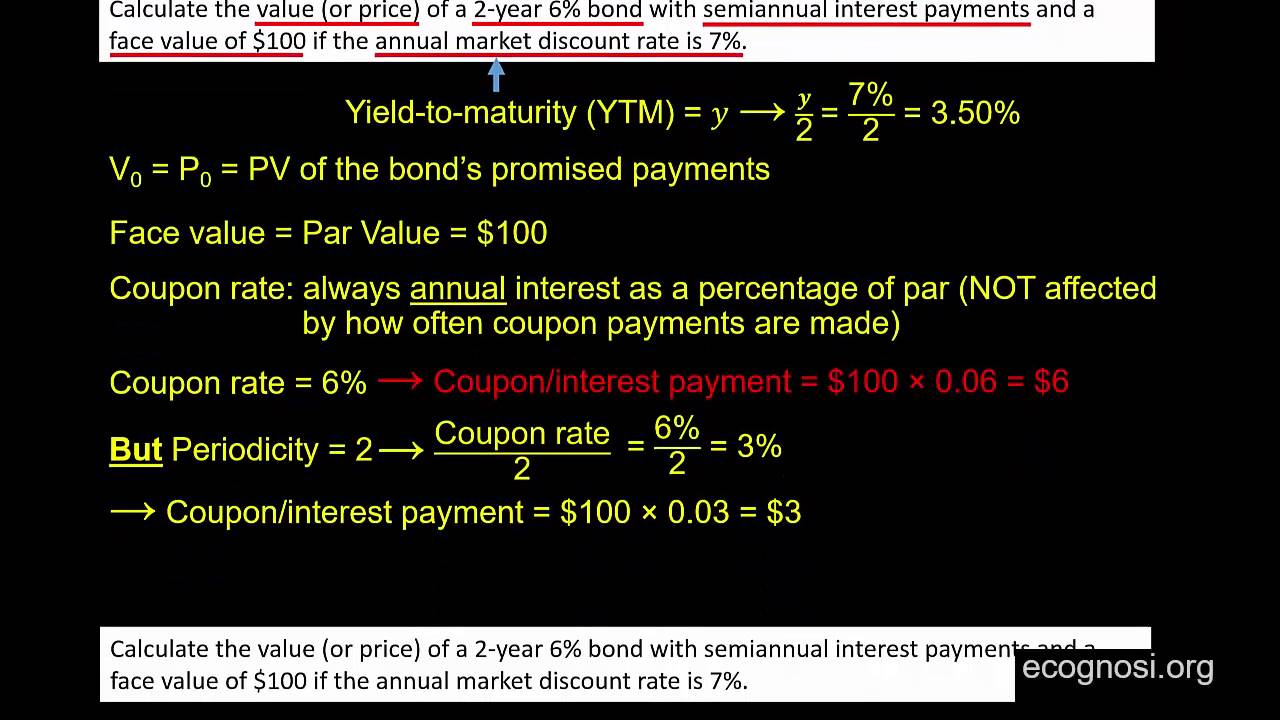

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... globallegalchronicle.comGlobal Legal Chronicle – Global Legal Chronicle 2 days ago · Goodwin Procter advised FogPharma® on the deal. FogPharma® announced its $178 Million Series D financing. FogPharma is a biopharmaceutical company pioneering a new class of precision...

What is a coupon payment on a bond. › Calculate-an-Interest-Payment-onHow to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. For example, you may see a 5% coupon on a bond with a face value of $1000. In this case, the coupon would be $50 (0.05 multiplied by $1000). It is important to remember the coupon is always an annual ... globallegalchronicle.comGlobal Legal Chronicle – Global Legal Chronicle 2 days ago · Goodwin Procter advised FogPharma® on the deal. FogPharma® announced its $178 Million Series D financing. FogPharma is a biopharmaceutical company pioneering a new class of precision... home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "40 what is a coupon payment on a bond"